What is Yahoo Finance

The Yahoo Financial website is considered one of the largest, most important and most popular investment sites of all due to the enormous information it contains and its ease of use.

Here we will talk about this site and how to benefit from it in the desired manner. We will not review the steps for use in boring detail, but rather we will try to review its contents and what is in it.

Information and services in a way that enables the reader to benefit from the site well and effectively.

Go to the site and register with [Yahoo], and if you are a [Yahoo] user, you only need to register once. After registering and choosing a username and password.

Go to the site to find the home page, through which you can create a portfolio or several portfolios to follow stocks and perform the necessary financial and technical analyses.

Yahoo Finance.

How to Create own wallet on (Portfolio)

First open your own wallet.and put in some information about the shares you're following or you interested in.

The ones you own, and you can open several governors with different names and for different purposes. So you can create.

One technology stock portfolio, one energy stock, one high-risk stock, and so on.

The process of creating the Yahoo portfolio

The process of creating the portfolio is done by choosing Create, which you will find opposite the word Portfolio at the top of the screen.

When you enter the Create form, choose Track a symbol watch list and then set up

The contents of the wallet are as follows:

Step 1: Choose a specific name for the wallet, such as Tech, and leave the currency type in dollars as it is.

Step 2: Enter the stocks (Symbols) you want to follow, and if you do not know Company Code Temporarily enter the symbols INTC, CSCO, IBM, and later you can search for the symbol by the company name or the first part of it (by clicking the Look Up Symbol link). After that mark “9” on the indices that you want to add to the portfolio, such as the Dow Jones and Dow Jones indices [NASDAQ].

Step 3: Choose the alphabetical order for the symbols to appear sequentially when displayed on the screen. Choose the detailed view of the portfolio to be able to view the portfolio in detail.

Step 4: This step is optional and through it you can specify the number of shares you own, the purchase price and date, and the commission paid. You first need to click on Finished and then click on the word Edit that you find under the name of the portfolio you chose. You usually do not need to enter all these details in every portfolio you create, but it is useful for those who want to monitor the performance of their portfolio and control it. For example, you may need to enter the upper and lower limits of the share price if you want to be notified when the share price exceeds one of these limits, thus avoiding the necessity of constantly following each stock, especially if you are following a large number of stocks (one hundred shares, for example). After specifying the upper or lower limit, or both, [Yahoo] places a “^” sign at the share price in the portfolio. This happens if the stock exceeds the upper limit. and a “v” sign is placed if the stock falls below that limit.

Upon completion of this process (by clicking on the Finished button), you will find the name of the wallet that was created in the space designated for Portfolios, and you can view its contents by clicking on the name of the wallet.

What services are available on Yahoo Finance and how to benefit from them?

Yahoo allows you to view the wallet in several ways, called Views, which you can find on the top line of the wallet, including the Detailed method, which we chose when we created the wallet in the previous paragraph.

Other methods include the following:

- The shortcut (Basic) method displays the data on one line without showing the stock map. It is useful for those who connect to the Internet at a slow speed, or who would like to review a large number of stocks in a quick way.

- The daily monitoring method (Daywatch), which gives more information than the shortcut method, in addition to showing a sign that the price has exceeded one of the upper or lower limits, as we mentioned a moment ago.

- Performance method, which shows the extent of profit or loss in the portfolio in dollars and in percentage.

- Real-time ECN method, in which you can follow real-time prices for free, but you must be aware that these prices are not the real-time prices of the stock exchange or Nasdaq, but rather the prices of private trading networks, and their prices are close to the official prices, but they are not identical.

- Create a new view. Here you can create your own method so that you specify the information that is displayed in it, and you can add basic data such as the earnings multiple, book price, etc., and add whether the price is higher than the moving average or not, and so on.

Now choose the Detailed view and you will see the full details of the portfolio, the contents of which we will review below, see Figure.

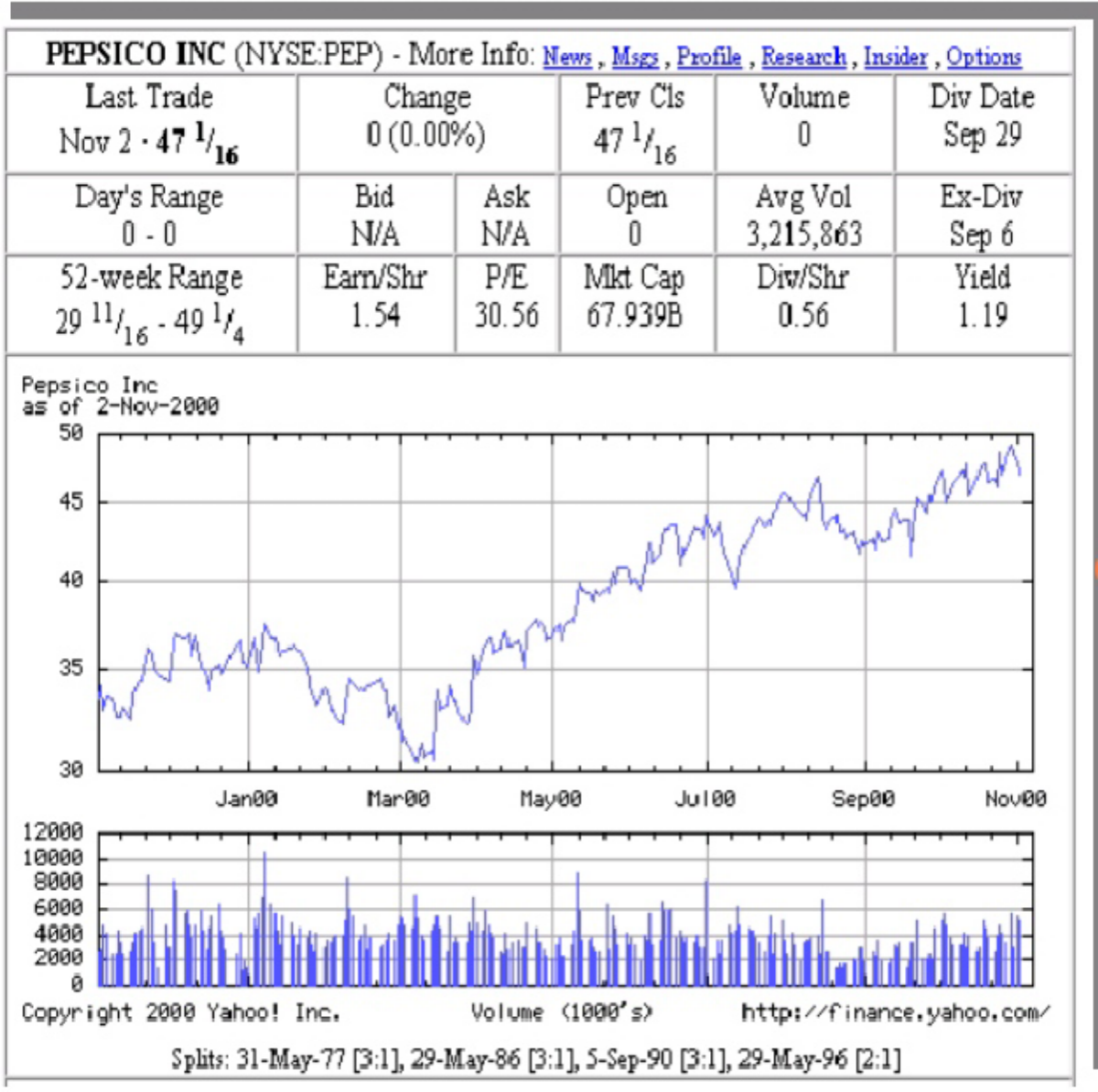

Look at the information for a portfolio stock, and notice how the first line shows the full company name, the stock symbol (PepsiCo in this case) and the abbreviation of the name of the market on which it trades, which is usually either Nasdaq, NYSE, AMEX, or OTC, and in the case of [NASDAQ]

The type of market is also clarified, including the National Market (NM), which is the largest market [NASDAQ], or SC (Small Cap), or the small-cap market.

For the OTC market it may be BB (Bulletin Board), which is the market for companies that are not rated by [Nasdaq] and are usually viewed as risky, or Pink Sheet (PK), which is a similar market. It must be taken into account that some stocks are traded

In Canadian markets (Toronto, Alberta, Vancouver).

See the website for some information about other markets.

Below the details of each stock, you will find some hyperlinks dedicated to obtaining more information, including the following:

- The company's news site (News) provides news items throughout the day about the company's latest developments, including earnings reports and company developments from the recommendations of senior analysts.

- A company overview place (Profile) that contains a huge amount of information about the company, including an overview of the company, its latest financial results, and many numbers and statistics.

- A place for discussion forums (messages) through which various investors consult and exchange opinions about the company and its future. It is possible to participate in the discussion under a real name or a pseudonym.

- The location of the buying and selling reports made by the company’s people (who are the major investors, owners, and those on the board of directors) (Insiders), and this information is considered one of the important indicators that must be followed up because it gives an impression of the direction of those who are more familiar with the company than others.

- The Research site contains the results of the company's evaluation by leading analysts and brokers and the expected financial results for the coming years. Reports can be purchased through the site related to that company.

- Chart location: Here you can display stock maps and compare the performance of a stock with other stocks and metrics.

- The US Securities and Exchange Commission (SEC Filings) location, which contains the company’s annual and quarterly reports as submitted to the authority periodically.

- Financial numbers place, which is dedicated to detailed financial information about the company and its financial results, such as income statements, financial position, and cash flows.

- An information place about option contracts (Options), which displays all types of stock option contracts by months and years for companies that have option contracts.

On the right side, you will find a small map of the stock for one year, and below it are other options for reviewing the stock price at different periods.

As for the other of the information about each stock, the meaning of each one can be summarized as follows:

- Last Trade – the price of the last trade made, whether on the bid or ask side.

- Day's Range – the price range since the start of trading on that day.

- 52-week Range – price range over the past 52 weeks.

- Change – the amount of change in the stock price from the previous day’s closing price.

- Bid – the current ask price for the stock, i.e. the price at which you can sell the stock, and below you find order Quantity (Bid Size).

- Ask – the current bid price for the stock, i.e. the price at which you can buy the stock, and below you find display quantity (Ask Size).

- Prev Cls – previous closing price.

- Open – the opening price for the current day.

- Volume – the number of shares that have been traded so far during this day, that is, when you buy or sell for a thousand shares, this number increases by a thousand.

- Avg Vol – the average daily trading volume, which is calculated using the arithmetic average method, over the past 3 months, the benefit of this number is that it indicates how much trading volume varies, this day is different from usual.

- Earn/shr – earnings per share over the past four quarters and does not include extraordinary income, which comes as a result of the company completing some unusual business operations, or winning a case, etc, In addition to revenues that do not reflect the company's true profitability. Note that ttm means the last 12 months, and mrq means the last quarter.

- P/E – earnings multiple, calculated by dividing the current price by the earnings per share according to the four quarters past.

- Market capitalization (Mkt Cap) or the market value of the stock, which is calculated by multiply the number of company shares by the current share price.

- Dividend per Share (Div/Shr) or dividends per share refers to the dollar amount paid to a shareholder in one year.

- Dividend Date - This is the day on which profits are distributed and appear in an account the person directly.

- X-Dividend Date (Ex-Div), which is the last day on which the stock can be purchased to obtain profits that will be distributed according to the distribution date (Div Date).

- Yield – earnings per share, calculated by dividing the earnings per share by the share price and shown as a percentage - if the earnings per share equals $1 and the share price is $50, then the return is 2% or 2.00.

There is data added later in Yahoo, and you can find it in Key Statistics, including:

- 1y Target Est – the expected price of the stock within a year, which is the average of the opinions of analysts who follow the company. Details of this can be found in the Analyst Estimates.

- P/S – stock price divided by sales per share, gives another dimension when comparing stock price, rather than P/E.

- PEG – price on growth, and helps a lot in interpreting the meaning of P/E and taking the company’s growth into account.

Profile page

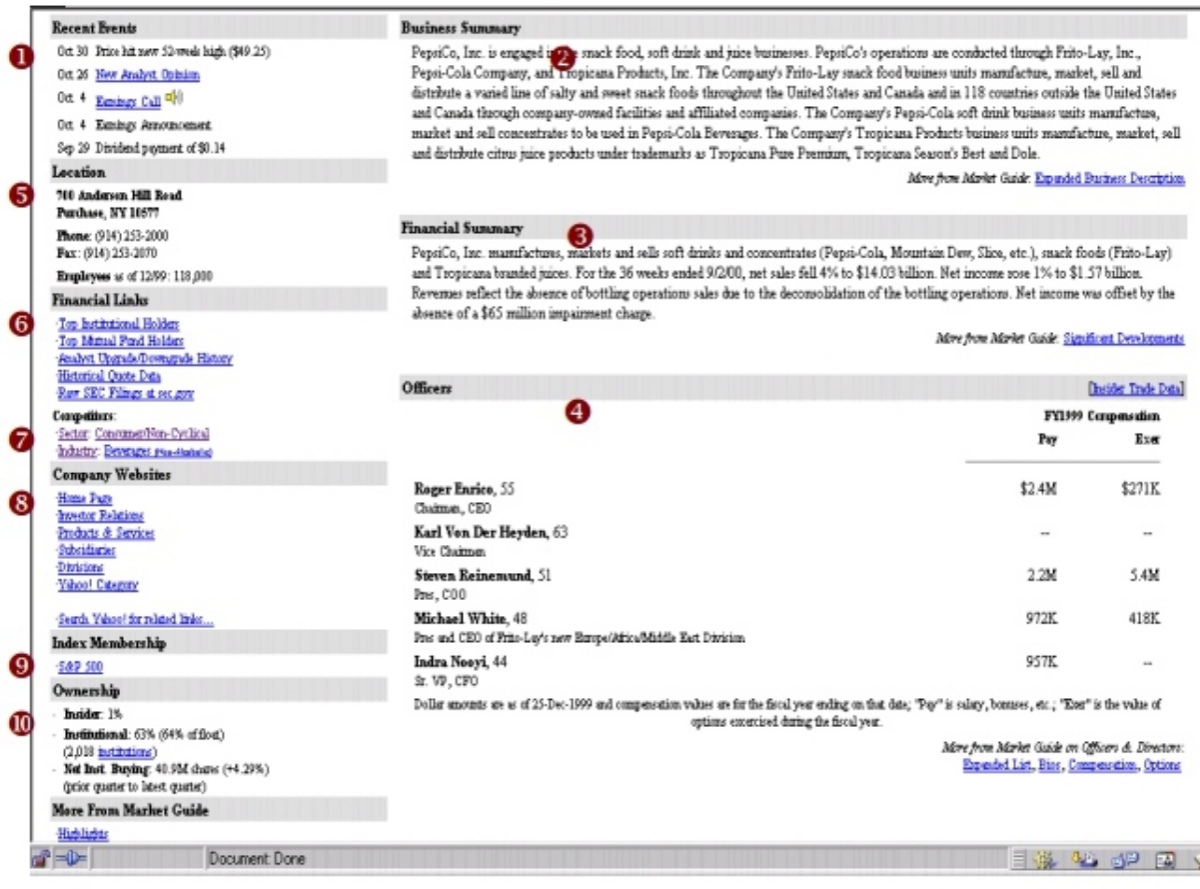

Here we review the contents of the Profile page for the famous Pepsi-Cola company with the symbol PEP See Figure and follow the numbers shown in the figure.

Some paragraphs you may find in the information column to the left of the screen.

- Recent Events – In this box, the most important developments of the company in the recent past are presented. Sometimes there is an Upcoming Events box, which displays the most important upcoming developments, including the date of announcing the financial results and the date of dividend distribution.

- Business Summary - contains a summary of the company and its various activities.

- Financial Summary - contains the latest sales and income figures and briefly explains why these numbers are higher or lower than previous periods.

- Officers - Here you will find some information about the company’s board of directors, their ages, and their allocations finance. For example, we see here that the CEO of the company receives an annual salary of approximately $2.50 million (as of 2004, his salary was more than $5 million!).

- Location - The company's head office address and phone numbers are located here.

- Financial Links - Here are some links that lead you to more financial information, including a list of the company's largest shareholders from different companies and entities. For example, we find that Barclay Bank owns more than 45 million shares of PepsiCo.

- Competitors - This page shows the company’s position among competing companies according to the sector and industrial field in which the company operates.

- Company Web Sites - Here you will find links that lead you to the company’s website on the Internet, including the company’s investor relations page and other pages related to the company’s work.

- Index Membership (company’s membership in indices) – This field indicates the name of one or more of the indices to which the company belongs, such as if the company is among the [Dow Jones] index companies or it is one of the [S&P 500] index companies or others. . (You may find this information on Industry page in the left column of the screen).

- Ownership a (ownership) - In this field you find the percentage of shares owned by company employees (Insiders) and some buying or selling transactions that took place during the past six months. For more details, you can refer to the link for the company’s employees, which you can find on the first line of the share details, as we mentioned previously.

There is also a page to list the results of the analysts’ analysis and evaluation (Analysts Upgrade/Downgrade). (History) over a period of approximately one year, in which you will find the name of the analyst or broker who conducted the analysis and the result of his opinion on the company. Usually the analyst carries out one of the following operations:

- Initiated - that is, the analyst began the process of following this company for the first time.

- Upgrade - There has been a positive change in the analyst’s opinion about the company’s future.

- Downgrade - There has been a negative change in the analyst’s opinion about the company’s future. The result of the analyst's decision varies according to his expectations about the company, and the classification used varies from one analyst to another, but most analysts follow the following system:

- Strong Buy – The analyst strongly suggests buying the stock at the current price

- Buy (valid to buy) - The analyst suggests buying the stock at its current price. If you search for the source of the analysis through some sites such as Briefing.com, you will find a detailed explanation of the analyst’s opinion as well as the expected price limit (Price Target).

- Hold (wait) - means waiting before buying the stock, and for those who own the stock, many people believe that this opinion means that the analyst suggests selling the stock.

- Sell (for immediate sale) – rarely used, it means that the investor must get rid of the stock quickly. Salomon Smith Barney uses the word “avoid” instead of “sell,” Instead (Source of funds) the term BT Alex. Brown and used from Sell.

There are other analysts who use other terms as follows:

- Market Perform – This means that the stock’s performance is in line with the market’s performance, Donaldson Lufkin, J.P. Morgan, Goldman Sachs before and used and others, Jenrette (DLJ).

- Market Outperform (better than market performance) – This view indicates that the stock is performing better than the market. It is expected to be better than the market performance in general.

- Accumulate (start accumulating the stock) - to start buying the stock at the right time, this suggestion less impulsive than Buy, and used by AG Edwards, Prudential Securities, and others.

There are other links that take you to the page for obtaining historical quotes. Another takes you to the SEC's website for the financial information as it was submitted to the SEC