About NASDAQ Market

National Association of Securities Dealers Automated Quote (NASDAQ) is a

market that began its operations in 1971 AD as a means of organizing the

trading of shares of many companies that did not have the opportunity to

register in the famous New York Stock Exchange

You may also like to read more about New York Stock Exchange

click here

The shares of these companies were bought and sold through market

makers in what is known as Market (over-the-counter), because shares were

bought and sold at a counter. and when the NASDAQ market is created for

trading Electronic, which is sponsored by the National Association of

Retailers Stocks (NASD), this market has become without a counter, and this

market does not exist in the form of an urban entity not at all like in the

New York market.

The NASDAQ market is made up of a large number of market makers who are

brokers, investment bankers, and other professionals working in the

financial markets located in various locations around the United States. The

number of market makers on the Nasdaq market exceeds five hundred, and they

use computers to link to the NASD stock trading network, through which stock

prices are displayed and buying and selling transactions are completed.

These Nasdaq mainframes are located in Connecticut (Trumbull, CT) and backup

machines are located in Maryland (Rockville, MD)

Offer and Bid in NASDAQ and the role of market makers

This sprawling market includes the shares of about 5,000 companies,

which is larger than the New York market in terms of the number of companies

and less than it in terms of market capitalization. For each stock, there are

many market makers, which may reach more than two hundred market makers for

some large companies, such as [Intel] and [Cisco], and this number increases

and decreases depending on the bid for the company or not. The number may be

large in the few days following the initial offering of some companies'

shares, and it decreases if the company's price falls and investors move away

from it. According to the NASDAQ law, there must be at least two market makers

for each stock, and some studies indicate that the average number of market

makers ranges from two to ten. The role of market makers is that they maintain

a certain stock of shares of the companies they deal with, and they buy and

sell directly, either for their own account or for the benefit of their

clients (brokers, brokers, and others), or they buy and sell between each

other according to certain conditions and controls. The Nasdaq system requires

the market maker to enter buy and sell orders on an ongoing basis in a

quantity of no less than 100 shares or 500 shares, depending on the nature of

the stock. The system currently requires, with regard to small stocks, that

the offered quantity and the required quantity that the market maker is

obligated to show must not be less than 100 shares. If the average daily

trading volume is less than 1,000 shares and the share price is more than $10,

and for other stocks, the quantity must not be less than 500 shares, and in

large stocks, the quantity must not be less than 1,000 shares.

Market makers are not allowed to compete with each other in buying and

selling, because the goal of the presence of market makers is to provide the

market with the necessary liquidity at all times, not to compete with each

other. This means that it is not permissible for a market maker to enter a buy

order, for his own account, at the sell price entered by another market maker,

or to enter a sell order at the buy price entered by another market maker. But

of course he has the right to enter a purchase price that is higher than the

purchase price of another market maker and compete with him to buy, or to

enter a sell order that is lower than another market maker’s sell order and

compete with him to sell.These controls do not apply if the orders placed by

the market maker are orders for his clients, that is, not for the benefit of

his own account. The system also prevents market makers from using programmed

methods to modify buy and sell orders, the so-called Autoquote.

The aim of this is to prevent them from changing their orders quickly in

order to stay away from the execution prices.

The average investor does not often deal with market makers directly.

Rather, this is done through a broker or intermediary, either manually, as

was the case in the past when the broker takes the order and directs it via

the computer to the market maker, or the process is done electronically, and

the broker’s device By taking the customer’s order from the Internet and

directing it to one of the market makers he deals with, who in turn either

executes it directly for his account on the condition that he does not

execute it at a price weaker than the price available in the market, or he

sends it to the central Nasdaq devices so that everyone can see the

order.

|

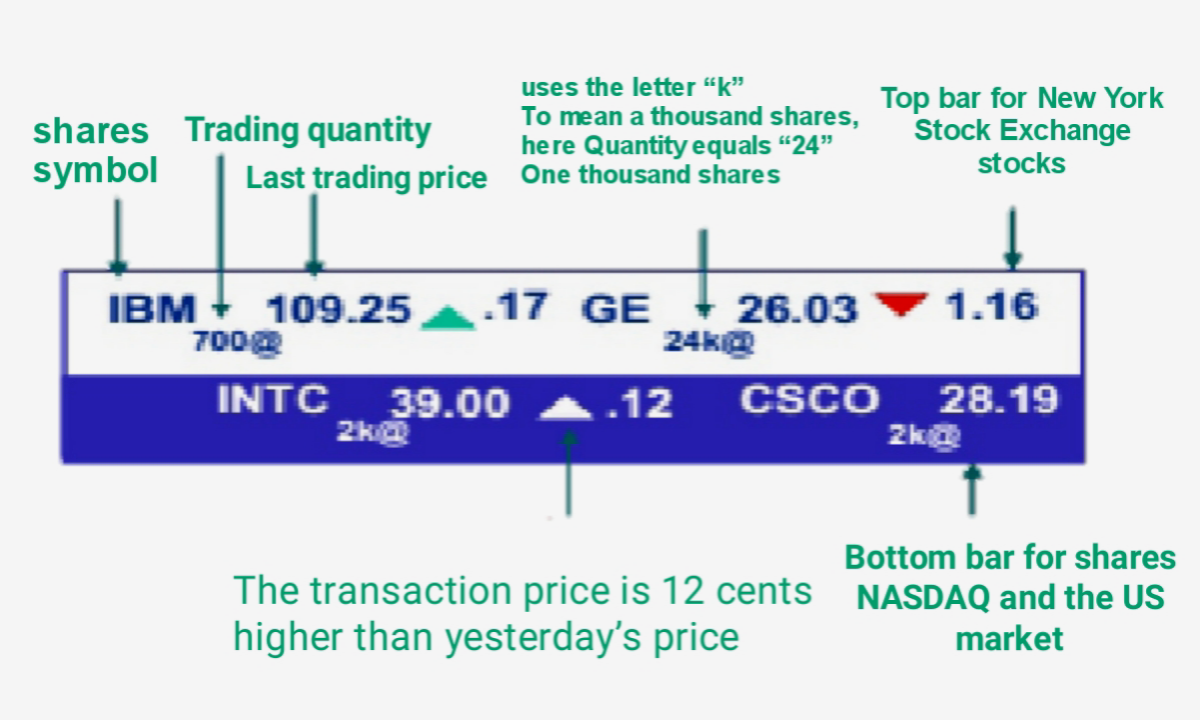

| Figure: shaw the price bar as seen on CNBC TV, usually coming in 20 minutes later |

The investor can obtain stock prices through any of the price services

available on the Internet (Quote Service) and according to multiple levels of

transparency (as we will see shortly), or watch the prices on television, as

some television stations publish the prices in the form of a ticker in the

video. At the bottom of the screen, as shown in the example shown in the

previous figure. Note that the bar does not display the bid and ask prices, it

only indicates the price of the last trade and the quantity at which it was

completed. The Nasdaq market joined the American Stock Exchange in 1998, and a

company was formed between them to follow the development and performance of

the two markets, while both markets remain in their current form, meaning that

this change does not affect dealing in the two markets, and the Nasdaq market

remains a market. It is electronically composed of market makers, and the

American market remains a central market that relies on the role of the

specialist, like the New York market.

Trading between bid and ask prices

A new regulation of Nasdaq's work emerged based on guidance from the US

Stock Exchange and Markets Commission in 1997 AD, stipulating that market

makers must display limit orders that come from investors way of determining

whether these orders are better than the current bid and ask price. And aims

is regulation prevents market makers from exploiting the information they have

to manipulate prices, and thus wasting the opportunity for the investor to get

the best prices. To illustrate the way the organization works, let us assume

that the current bid price is $18 and the ask price is $17.75.

Bid=$17.75 size=200. Offer=$18, size=200

If you want to buy 200 shares and do not want to pay the offer price,

you may set the purchase order at 17.88 Dollars, and naturally the order

will not be executed at this price because the current offer price is still

$18. But the benefit of the new Nasdaq system comes because it forces market

makers to change the asking price.

The current range is from $17.75 to $17.88, meaning that the best price for

those who want to sell now is $17.88. The bid and ask prices are changed

after the new order arrives as follows:

Bid=$17.88, size=200 Offer=$18, size=200

Note that the offer price is still $18, and this means that you will

not be able to buy at less than that price, but the real benefit appears

when a sell order comes at the market price by someone else or by one of the

market makers, so the price that the seller gets is 17, $88 (asking price),

so the seller got a better price than the original asking price ($17.75) and

the buyer got a better price than the original offer price ($18). This

process is known as the process of buying and selling between supply and

demand. There is an exception to this law in that it does not apply to

conditional orders with an all-or-none characteristic, and it does not apply

when the quantity is less than one hundred shares, meaning that the market

maker is in In such cases, the customer is not obligated to show the order,

even if it is better than the current price.

Before the issuance of this regulation, market makers used to hide the new

price from the screens and thus the order would not be executed in this way.

The benefit from this regulation is good, and indeed the difference between

the bid and ask prices decreased significantly after the issuance of this

regulation.

What you need to know about market makers

The goal of market makers is ultimately financial profit, but their presence

in the markets is necessary because they provide the market with continuous

liquidity, even though they receive a share of risk in return. If people

rush to buy the stock, the market maker must supply them with shares, either

from his own account if he has shares, or through pre-selling (selling

shares to other customers), or if he can, he may let them buy from other

sellers. When people start selling, the market maker must buy to increase

his inventory level, or to cover a previous sale he made previously.

One of the strategies carried out by market makers that must be known is

those cases in which the market maker offers large quantities of his shares

for sale at a certain price, especially when he finds that he has a large

stock of shares, so this price area is a resistance area for the stock.

Without it, he cannot progress. At the same time, the market maker enters

large buy orders at a lower price. The result is that he sells at a high

price and buys at a low price. This method is known as arbitrage, and it is

a very profitable method if the market maker can apply it well.For example,

a market maker can offer his shares for sale at $20 and buy them at $18,

making a profit of $2 per share. Of course, he exposes himself to risk in

the event of a large sale of the stock, as the stock may fall below $18,

while he has many shares left for sale at a price of $20. You may need to

know the support and resistance areas. From here, you know that it is

necessary to sell at the resistance area ($20 in this example) And buy at

the support area ($18 in the example).